Data Strategy in Venture Capital

Data in the Public Markets

Benjamin Graham and the early days of investing.

100 years ago Benjamin Graham popularized the idea of value based investing for public market investors. The idea was simple. Markets were so inefficient that companies traded below the value of their net assets. Investors could make an almost guaranteed return buying these stocks since they were valued terribly. They were priced not just well below the discounted value of future cash flows but below the liquid assets the company had on hand.

For non-finance people, let me put this into perspective. Imagine being offered a wallet with $100 in it for $80. The fact that the cash is physically located in this wallet doesn't change the value of the cash itself! Purchasing $100 for $80 is always a good deal. This silly example was how irrationally priced assets were in the 1920s. Investors were buying companies that had more liquid assets than their trading price.

The best part about this strategy was that it was so simple! If an investor could get their hands on the financial reporting of a company, they could quickly tell if the opportunity was worth investing in.

Fast Forward to Today

Using data to understand the fair value of an asset has evolved from the days of Benjamin Graham. In the intervening period, we've developed asset pricing models, reasonably efficient markets that trade on available information, and even hedge funds that employ specialized data gathering techniques to better price assets.

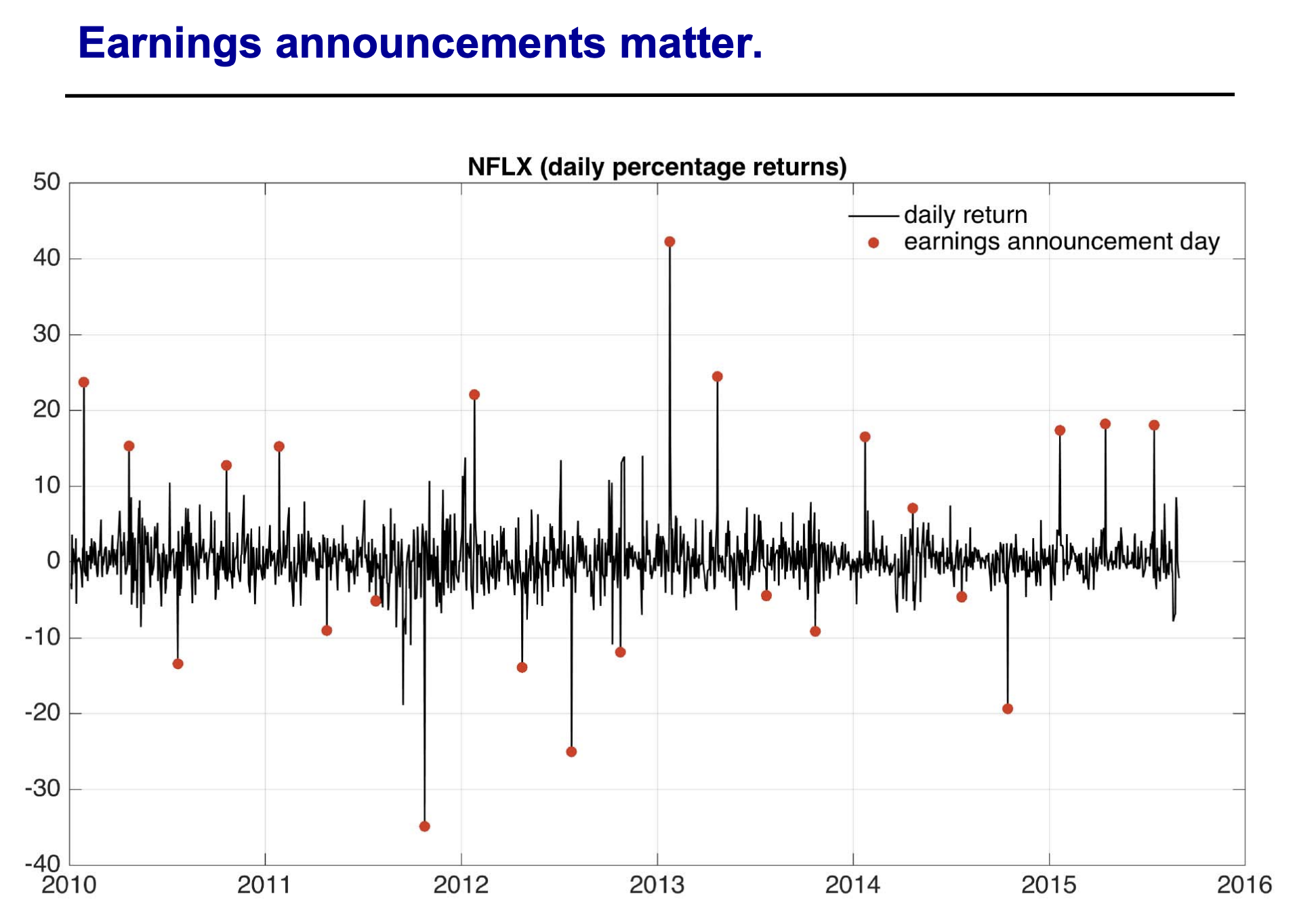

Quarterly financial reporting is a standard practice for public companies with audited financial statements and tight regulations. Earnings announcements are big news for companies, with markets reacting immediately to information updates and prices reacting accordingly.

The chart below is from an academic paper showing volatility for Netflix overlaid with earnings announcements.

As new information is made available, investors react and reprice the underlying asset.

Private Investors barely know how their companies are performing

While public market investors are using advanced data collection techniques, such as satellite imagery to view parking lot traffic, and instantly consuming new information to reprice assets as it becomes available, private market investors frequently have no idea how their investments are performing. It's common for an investor to make an investment in a company and not hear another word until there's a liquidation event (like an IPO, acquisition, or bankruptcy).

Private markets are notoriously opaque. There are no reporting requirements from the SEC and audited financials are incredibly rare until companies hit at least their Series B. There are a litany of reasons that startups do not report well to their investors but that's probably best saved for another blog post.

Most venture capital firms get financial updates from less than 50% of their companies quarterly. This percentage varies with the amount of effort firms put into gathering data. For instance, firms who use portfolio monitoring software will often see collection rates increase to 70% or higher!

The most sophisticated investors have entire teams dedicated to gathering data from their portfolio and can actually end up being pretty successful, with some firms getting up-to-date information from 100% of their companies.

While I've highlighted some success stories, there are many investors, particularly investment managers who do not lead rounds after Series A, who have almost no information on their portfolio companies.

Even the bare minimum insight on performance is an advantage

In public markets, the bar for superior market information is incredibly high. Proprietary data acquisition leads to small points of alpha for investors. To get a data advantage in venture, investors literally just need to ask their portfolio companies for data. This isn't brain surgery. Even having last quarters' financial statements and ARR number will put you ahead of most other investors.

Early stage startup numbers matter much less than public market numbers because of the volatility of future growth and how quickly things can change. While numbers matter less for startups, they are still very valuable. As an investor your job is to price risk, performance numbers give you a better picture of the asset you're buying and the risks associated with it. Exactly which numbers are valuable and how valuable they are are topics for another time. If you have no knowledge of a company's performance, how could you possibly price their risk!

Venture investors don't need fancy models developed by physics PHDs to eek out differential returns. Running a weather simulation to predict crop futures prices and the corresponding equity impacts are not going to be useful in analyzing your Series A mushroom based makeup company.

Knowing that your company has seen strong growth in their professional services business unit, which is fueling top line growth, helps you understand that the margin profile of the business may change, and your underwriting multiple in the next round may need to adjust as a result.

There are lots of insights into performance that can be gleaned from basic analysis of your companies' metrics that help with valuing the business, providing operating advice to the team, and inform your decision at the next financing round.

Public marketing investing rigor and data intensity provides a clear blueprint for the private markets.

Private markets and public markets are very different with a lack of liquidity serving as both a feature and a bug (a post for another time). The value of real-time data consumption is much lower in private markets as a result of this lack of liquidity.

While private markets are different from public markets in the do or die nature of acting on information, a fundamental understanding of a companies' operating and sector metrics allows investors to make better asset allocation decisions. Collecting data is the first step in analyzing companies, and the best firms take the time to dive deep on their companies performance. The rigor that public market investors and even private equity investors apply to the analysis of their companies are returns left on the table by venture investors.